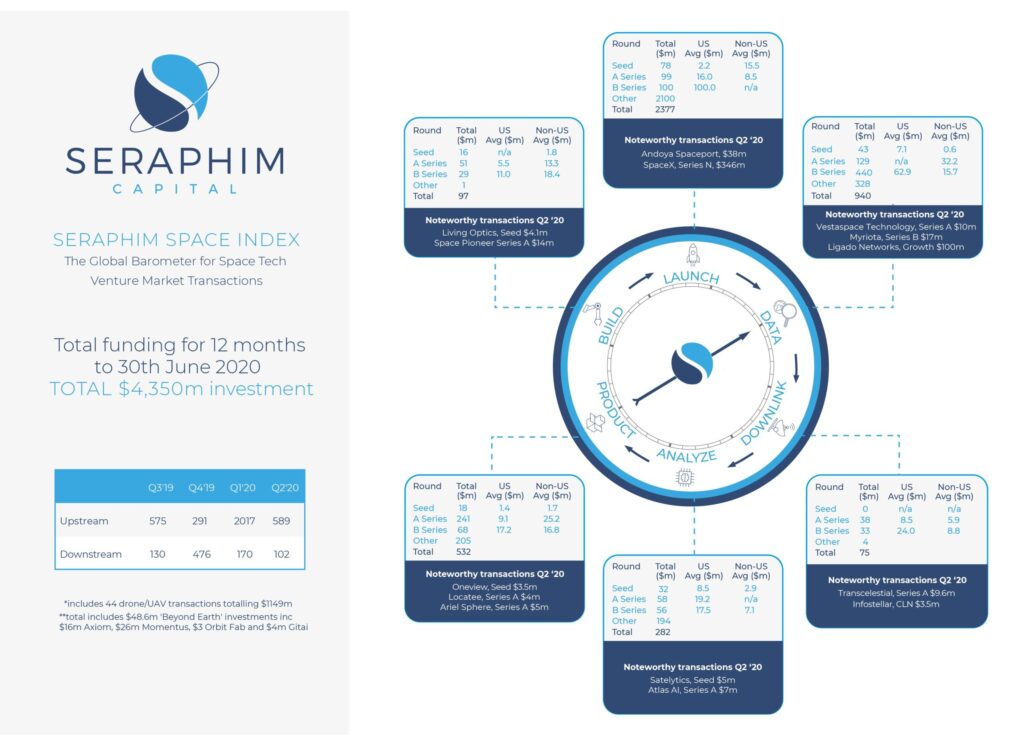

We were eager to see the 30th June 2020 figures for the Seraphim Space Index to better understand the impact of the Covid pandemic on the appetite for venture investment in the global space technology domain.

The Q2 2020 total investment was $672m including $346m investment into SpaceX. Compared to Q2 2019, which also included a sizeable $536m SpaceX investment, the Q2 20 investment saw an increase of 12%. Investment gains across most sub-categories led by a 5 fold increase in constellation investment at $173m, with Analysis and Product categories up by 191% and 31% respectively. Two categories saw declines Launch and Downlink both falling by 29% to $384m and $13m respectively.

Regionally US investment was down by 15% to $492m whilst investment in Asian companies was buoyant increasing 3 fold to $89m, followed by European investment up by 68%.

Investment across the Early Stages saw a positive increase with Seed up 73%, A series 56%, B series 35% whilst Growth Stage investments were flat, down by just 1%.

Capital concentration Q2 2020 versus Q2 2019 were consistent. After allowing for outliers SpaceX and Oneweb investment the next top 5 investments in Q2 2020 accounted for 27% of all investment versus 32% the year earlier. In relation to the top 10 investments, they accounted for 47% of total investment across both quarters.

Looking at the rolling full year figures to 30th June 2020 a total of $4.31bn was invested in the year compared against $4.07m in the previous year. Removing associated HAPS/UAV related investments the space specific headline was $3.16bn which was 12% down Y-o-Y. This included $846m Investment into industry bell weather SpaceX versus $809m the previous year.

From a sector category perspective Launch remained the focus for VC investors totalling $1.35bn over the year, up by 7% Y-o-Y. Also ahead was investment into companies that undertake Analysis of satellite data which nearly doubled to $235m. Companies that incorporate satellite data into their Products nearly tripled to $464m. Headline investment into satellite constellations fell by 46% to $901m. However, the 2019 data included a $1.25bn investment in the recently troubled broadband internet startup OneWeb. Removing this as an outlier reveals that the underlying investment into constellations was buoyant, more than doubling the previous years figure. The hardest hit category was Build, the companies making components and/or building satellites which fell by 57% to $83m.

Regionally, total investment into US based companies fell by 20% Y-o-Y to $2.29bn. However, after removing the OneWeb outlier US investment actually increased by a healthy 43%. Investors stepped up their commitment to European companies increasing their Y-o-Y investment by 56% to $276m followed by Asian companies accessing 25% more investment across the year totalling $531m.

Y-o-Y investment across Early Stage saw a positive increase with Seed up 172%, A series 21%, B series 55% whilst C series saw a 5 fold increase to $435m. At the headline level growth investment in later stages fell by 51% to $1.2bn, however, again the OneWeb outlier into account the level of growth staged investment was flat, down by just 2%.

Overall the spacetech sector has demonstrated resilience in the face of Covid – despite this we still remain cautious on the overall outlook for VC investment in the sector for the 2H 2020.