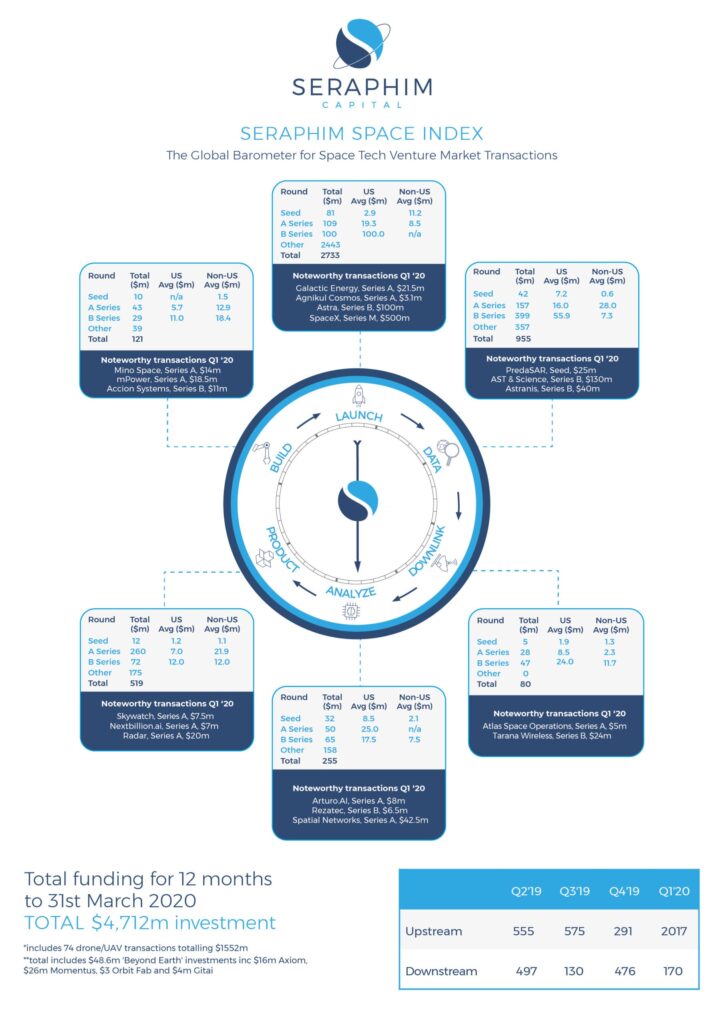

We’re pleased to announce we’ve just completed our analysis of the last quarters Space Tech Venture Capital transactions, amounting to $2.1bn in the quarter period to 30th March 2019, $4.7bn for the 12 month period. Every quarter we carefully monitor the investment in the Space Tech sector globally over a rolling 12 month period, highlighting key investments from the Quarter. We’ve broken out the sub-categories of the Space Tech ecosystem and highlighted total investment and the average size investment in Seed, Series A and Series B. We’ve also compared average round sizes for US companies versus non-US based companies. The latest index demonstrates continued growth by VC investors globally. Total investment grew by 17% year-on-year expanding from $4bn to $4.7bn.