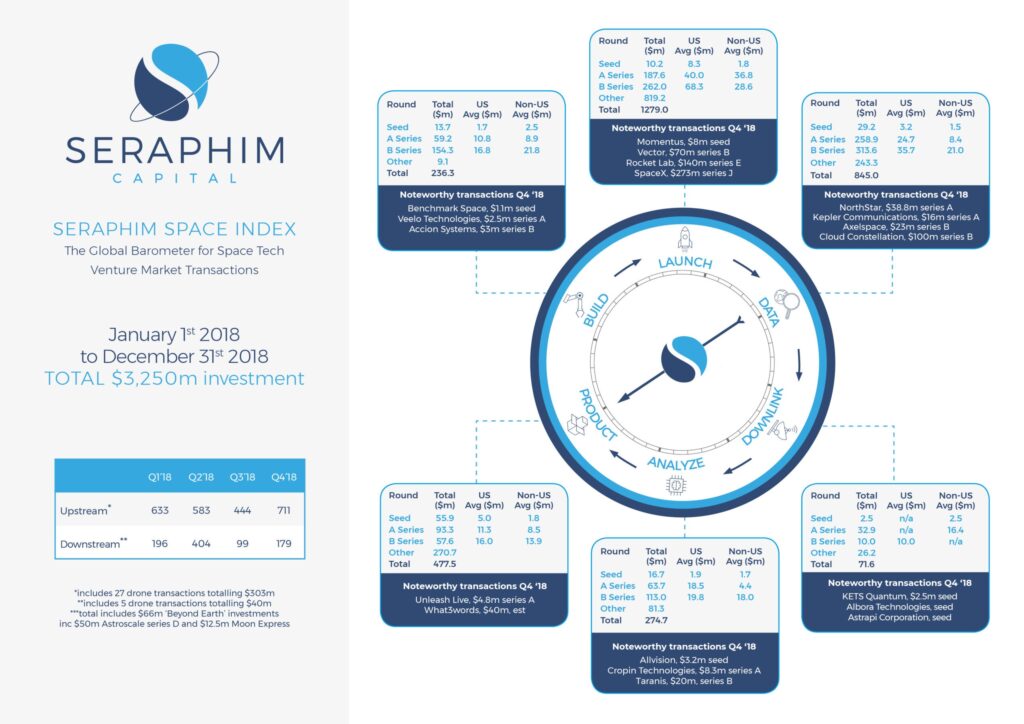

The latest Seraphim Space index demonstrates the growing appetite for space tech by VC investors globally. Total investment grew by 29% during 2018 expanding from $2.5bn to $3.25bn. Whilst SpaceX generates most of the press coverage it accounted for just 15% of total investment in 2018 ($487m) versus 18% in 2017 ($450m). US companies received the majority of funding accounting for 64% of 2018 investment, a 1% increase on 2017. European companies improved their global share of investment from 13% to 18% over the period.

The Index reported that 182 companies were venture financed during 2018 versus 131 in 2017, the growth was fuelled by investment into earlier stage investments verses the top 5 companies funded which accounted for $1bn in both 2018 and 2017. The index, which identifies average investment round sizes for each sub-sector, revealed that US companies continue to access materially larger rounds increasingly across Seed, Series A and Series B. The only sub-sector to buck this trend was Build (space hardware, software and engineering, materials, energy and robotics).

Overall investment in the sector is still driven by Launch which accounted for 39% of total investment ($1.3bn). The number of companies funded was broadly flat 19 versus 17 in 2017 with investment into growth rounds (B series and later) accounting for $1.1bn versus $640m the previous year displaying a maturing of the sector. In 2018 small sat dedicated launchers such as Rocket Lab ($140m) and Vector ($70m) raised substantial rounds and in the case of the former commenced commercial operations. Investment outside of US launch businesses gathered momentum with Landspace ($43m) and OneSpace ($44m) in China.

Activity related to Build (eg sensors, electronics, battery) was flat on the year $236m vs $262m across 28 companies respectively. Growth investment (B series and later) was flat at $154m versus $141m. However, European investment escalated to 36% of total versus just 4% previously. Key investments in the year included Reaction Engines ($37m) and Oxford Space Systems ($8m) in the UK, as well as Apollo Fusion ($10m) in the US.

Investment in satellite constellations and airborne platforms for collecting and disseminating Data rose by 27% to $845m across 51 companies. Investment in growth companies (B series and later) soared by 52% to $444m in this maturing subsector including companies such as Cloud Constellation ($100m). The uplift was largely driven by US investment up from 44% to 65% of the subsector. Notable transactions outside the US included the likes of Iceye ($34m, Finland) and Axelspace ($23m, Japan).

Downlink represents the companies communicating data from these platforms back to the ground stations. Despite being an important element of the supply chain, overall investment was down to $110m from $127m a year earlier. Whereas 2017 saw a large investment into antenna company Kymeta ($74m series E), 2018 investment was focused more on earlier stage with only $34m invested in growth stage businesses. European companies in this sector accounted for 47% of total investment, including companies such as Goonhilly Earth Stations ($32m). We see a surge of interest in quantum cryptography technologies that will drive investment in this subsector going forwards.

Investors piled into Analysis companies in 2017, backing companies to manipulate large unstructured datasets supporting emerging leaders such as Orbital Insights ($50m) and Mapbox ($164m) whereas in 2018 ‘mega-rounds’ were not a feature of this subsector. Consequently, investment fell from $410m to $275m. Within this only $165m was invested in growth during 2018 versus $384m a year earlier. Notable investments included Taranis ($20m) and Ursa Space ($6m).